Are you an aspiring trader looking for a structured and potentially lucrative trading environment? Look no further than FTMO Challenge, a prominent proprietary trading firm that offers a unique opportunity for traders to showcase their skills and potentially secure funding to trade on behalf of the firm. However, the FTMO journey is not without its challenges. In this comprehensive guide, we will delve into the intricacies of the FTMO program, providing an in-depth understanding of the requirements, benefits, and rewards associated with the prop trading firm. Additionally, we will offer valuable insights into overcoming the FTMO challenge, strategies for maximizing success, and an honest assessment of the firm’s reputation.

Exploring FTMO: Unveiling the Requirements, Benefits, and Rewards of the Prop Trading Firm

Before embarking on the FTMO journey, it is essential to understand the requirements, benefits, and rewards associated with the program. Let’s take a closer look at each aspect.

1. FTMO Requirements:

To be eligible for the FTMO program, traders must meet certain criteria. These include:

- Eligibility: The program is open to individuals aged 18 and above with a fundamental understanding of financial markets and trading strategies.

- Trading Experience: Traders must have a minimum of 3 to 6 months of documented trading experience or equivalent knowledge.

- Account Funding: To participate in the FTMO challenge, traders must fund their FTMO account with a minimum of $150.

2. FTMO Benefits:

Participating in the FTMO program comes with several benefits, including:

- Access to Capital: Upon passing the FTMO challenge, traders are provided with a funded trading account ranging from $10,000 to $200,000, depending on their chosen package.

- Profit Split: Traders receive a share of the profits they generate, with the percentage increasing as they move up in account size.

- Risk Management: FTMO provides traders with strict risk management guidelines to help them manage their trades effectively.

- No Personal Capital at Risk: Traders do not have to risk their personal capital, as the funded account is provided by FTMO.

- Flexible Trading Strategies: Traders can use any trading strategy they prefer, as long as it adheres to the risk management guidelines.

Evaluating the FTMO Challenge: Understanding the Parameters, Duration, Evaluation Process, and Success Rates

The FTMO challenge is the first step in becoming an FTMO trader. It is designed to evaluate a trader’s skills and determine if they are suitable for the program. Let’s take a closer look at the parameters, duration, evaluation process, and success rates of the FTMO challenge.

1. Parameters:

The parameters for the FTMO challenge include:

- Trading Platform: Traders can use any trading platform they prefer, as long as it allows for trade copying.

- Trading Instruments: The FTMO challenge covers a wide range of instruments, including forex, commodities, indices, and cryptocurrencies.

- Trading Timeframe: Traders can choose their preferred trading timeframe, whether it’s day trading or swing trading.

- Maximum Drawdown: Traders must adhere to a maximum drawdown limit of 10% during the challenge.

- Profit Target: The profit target for the challenge varies depending on the chosen package, ranging from 5% to 10%.

2. Duration:

The duration of the FTMO challenge also varies depending on the chosen package. For the $10,000 account, traders have 30 days to meet the profit target, while for the $200,000 account, the duration is 60 days.

3. Evaluation Process:

Once a trader has completed the challenge, their account will be evaluated based on the following criteria:

- Profitability: Traders must meet the profit target without exceeding the maximum drawdown limit.

- Risk Management: Traders must adhere to the risk management guidelines provided by FTMO.

- Trading Style: Traders must demonstrate consistency in their trading style and follow their chosen strategy.

- Market Knowledge: Traders must have a fundamental understanding of financial markets and trading strategies.

4. Success Rates:

The success rates for the FTMO challenge vary depending on the chosen package and the trader’s skills. On average, the success rate ranges from 30% to 70%.

Unveiling the Financial Commitment: Exploring the FTMO Subscription Fees and Profit-Split Structure

Before signing up for the FTMO program, it is essential to understand the financial commitment involved. Let’s take a closer look at the subscription fees and profit-split structure of FTMO.

1. Subscription Fees:

To participate in the FTMO challenge, traders must pay a one-time subscription fee, which varies depending on the chosen package. The fees are as follows:

| Account Size | Subscription Fee |

|---|---|

| $10,000 | $155 |

| $25,000 | $275 |

| $50,000 | $375 |

| $100,000 | $540 |

| $200,000 | $720 |

2. Profit Split Structure:

Once a trader becomes an FTMO trader, they will receive a share of the profits they generate. The profit split structure is as follows:

| Account Size | Trader’s Share of Profits |

|---|---|

| $10,000 | 70% |

| $25,000 | 75% |

| $50,000 | 80% |

| $100,000 | 85% |

| $200,000 | 90% |

Becoming an FTMO Trader: A Comprehensive Overview of the FTMO Sign Up Process

Now that we have explored the requirements, benefits, and financial commitment of the FTMO program, let’s take a closer look at the sign-up process.

- Create an FTMO account: The first step is to create an account on the FTMO website.

- Choose a package: Traders can choose from five different account sizes, ranging from $10,000 to $200,000.

- Pay the subscription fee: Once the package is selected, traders must pay the one-time subscription fee.

- Pass the challenge: After paying the fee, traders will receive login details for their FTMO account and can begin the challenge.

- Evaluation and funding: If a trader passes the challenge, they will be evaluated, and if successful, will receive a funded trading account.

Deconstructing the FTMO Challenge: A Step-by-Step Guide to Navigating the Evaluation Process

The evaluation process can be daunting for many traders, but with proper preparation and understanding, it can be successfully navigated. Here is a step-by-step guide to help you through the process:

- Understand the parameters: Before starting the challenge, make sure you understand the parameters and adhere to them strictly.

- Plan your trades: Create a trading plan that adheres to the risk management guidelines provided by FTMO.

- Practice, practice, practice: Use a demo account to practice your trading strategy and become familiar with the trading platform.

- Stay disciplined: Stick to your trading plan and do not deviate from it, even if you encounter losses.

- Keep track of your progress: Monitor your progress and make adjustments if necessary.

- Stay calm and focused: The evaluation process can be stressful, but it is essential to stay calm and focused on your trading strategy.

Demystifying FTMO: What is it? A Comprehensive Explanation of the Prop Trading Firm’s Operations and Objectives

FTMO is a proprietary trading firm that provides traders with a structured and potentially lucrative trading environment. Its main objective is to find and fund talented traders and provide them with the necessary tools and resources to succeed in the financial markets. FTMO operates by evaluating traders’ skills through the challenge and funding successful traders to trade on behalf of the firm.

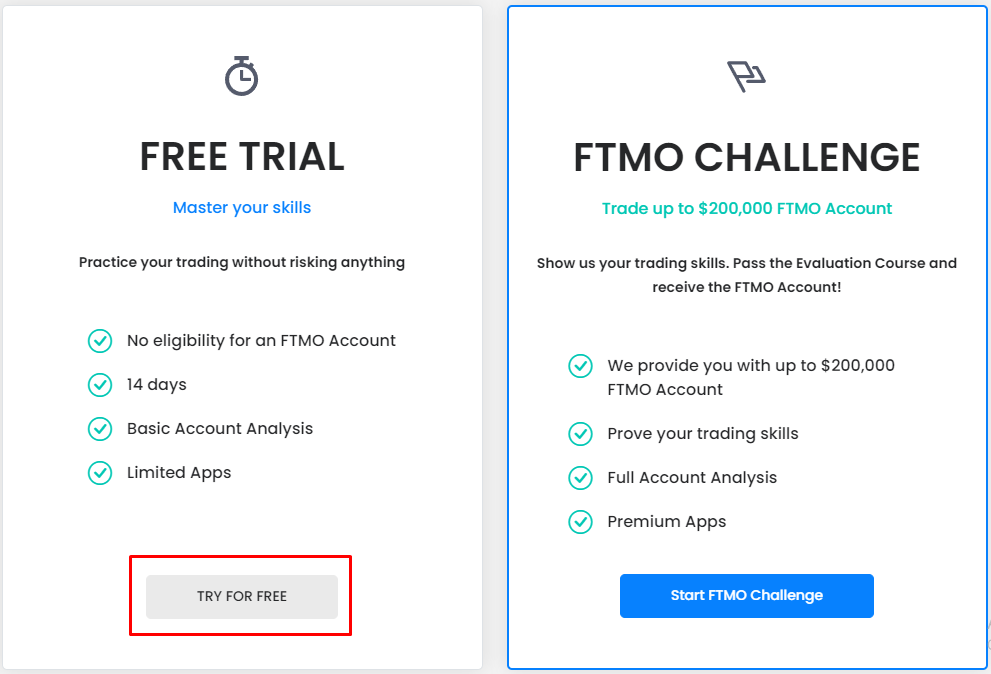

Unveiling the FTMO Free Trial: Discovering the Features, Limitations, and Benefits of the FTMO Trial Account

FTMO also offers a free trial for traders who want to experience the program before committing to it fully. Let’s take a closer look at the features, limitations, and benefits of the FTMO free trial.

1. Features:

The FTMO free trial account comes with the following features:

- $100,000 virtual capital: Traders are provided with $100,000 in virtual capital to practice their trading strategies.

- Real-time market data: The trial account uses real-time market data, providing traders with an accurate trading experience.

- Risk management guidelines: Traders must adhere to strict risk management guidelines during the trial.

- Profit target: Traders must meet a profit target of 5% within 30 days to pass the trial.

2. Limitations:

The FTMO free trial has some limitations, including:

- Limited duration: The trial lasts for 30 days, after which traders must sign up for the full program.

- No profit split: As the trial account is virtual, traders do not receive a share of the profits they generate.

- No personal capital at risk: Traders do not have the same psychological pressure as they would with a funded account.

3. Benefits:

The FTMO free trial also comes with several benefits, including:

- Experience the program: Traders can experience the FTMO program and its features before committing to it fully.

- Practice trading strategies: The trial account allows traders to practice their trading strategies without risking their personal capital.

- Identify areas for improvement: The trial account can help traders identify any weaknesses in their trading strategies and make necessary adjustments before participating in the full program.

Uncovering the Secrets of FTMO Success: Strategies, Tips, and Techniques for Overcoming the FTMO Challenges

To succeed in the FTMО challenge, traders must have a solid trading strategy and mindset. Here are some strategies, tips, and techniques to help you overcome the challenges and increase your chances of success:

- Understand the parameters: Make sure you understand the parameters of the challenge and adhere to them strictly.

- Practice, practice, practice: Use a demo account to practice your trading strategy and become familiar with the trading platform.

- Stay disciplined: Stick to your trading plan and do not deviate from it, even if you encounter losses.

- Keep track of your progress: Monitor your progress and make adjustments if necessary.

- Stay calm and focused: The evaluation process can be stressful, but it is essential to stay calm and focused on your trading strategy.

- Learn from your mistakes: If you fail the challenge, take the time to analyze your mistakes and learn from them for your next attempt.

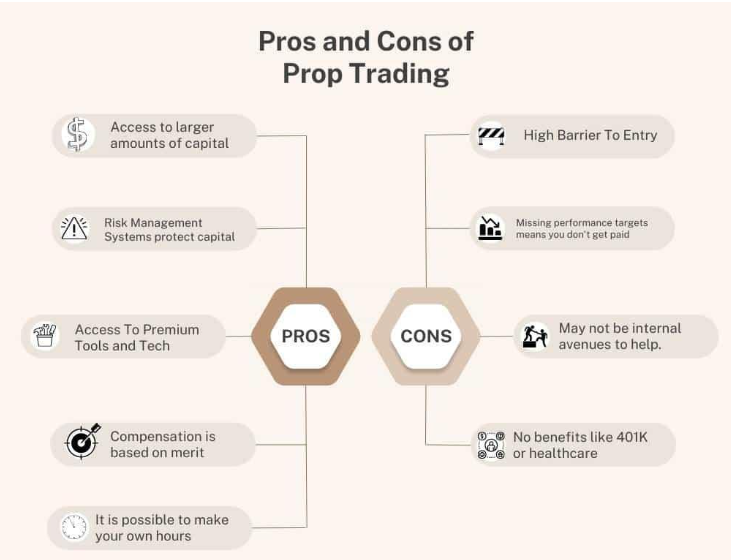

FTMO Review: Unveiling the Pros, Cons, and Overall Reputation of the Prop Trading Firm

Before signing up for the FTMО program, it is essential to consider the pros and cons and evaluate the firm’s overall reputation. Let’s take a closer look at the advantages and disadvantages of FTMO.

Pros:

- Access to capital: FTMO provides traders with a funded trading account, allowing them to trade without risking their personal capital.

- Profit split: Traders receive a share of the profits they generate, providing an additional source of income.

- Risk management guidelines: FTMО provides strict risk management guidelines, helping traders manage their trades effectively.

- Flexible trading strategies: Traders can use any trading strategy they prefer, as long as it adheres to the risk management guidelines.

- Free trial: The free trial allows traders to experience the program before committing to it fully.

Cons:

- Subscription fees: The one-time subscription fee can be expensive for some traders.

- Limited duration: The challenge has a limited duration, which can be challenging for some traders to meet the profit target.

- High failure rate: The success rate for the challenge is relatively low, with only 30% to 70% of traders passing.

Overall Reputation:

FTMО has gained a positive reputation in the trading community, with many successful traders attesting to its effectiveness. However, there have been some concerns raised about the high failure rate and the cost of the program.

Conclusion

The FTMО journey is not an easy one, but with proper preparation and understanding, it can be successfully navigated. We hope this comprehensive guide has provided you with valuable insights into the requirements, benefits, and rewards of the FTMО program. Additionally, we have explored the evaluation process, financial commitment, sign-up process, and tips for success. Remember, becoming an FTMO trader requires discipline, dedication, and a solid trading strategy. With determination and perseverance, you can overcome the challenges and potentially secure funding to trade on behalf of the firm.